Planning Your Legacy

Your desire to make a difference and leave a lasting legacy helps strengthen Lawrence's mission. Consider making an impact for students and faculty through a planned gift. These types of charitable arrangements may provide tax and other benefits to you while supporting Lawrence.

Our MissionGiving Options

-

Gifts of Stocks and BondsDonating appreciated securities, including stocks or bonds, is an easy and tax-effective way for you to make a gift to our organization.

More -

Gifts of Real EstateDonating appreciated real estate, such as a home, vacation property, undeveloped land, farmland, ranch or commercial property can make a great gift to our organization.

More -

Donor Advised FundYou fund a DAF and make charitable gift recommendations during your lifetime. When you pass away, your children can carry on your legacy of giving.

More -

Gifts of Retirement AssetsDonating part or all of your unused retirement assets such as a gift from your IRA, 401(k), 403(b), pension or other tax-deferred plan is an excellent way to make a gift to our organization.

More -

Gifts of CashA gift of cash is a simple and easy way for you to make a gift.

More -

Gifts of InsuranceA gift of your life insurance policy is an excellent way to make a gift to charity. If you have a life insurance policy that has outlasted its original purpose, consider making a gift of your insurance policy. For example, you may have purchased a policy to provide for minor children and they are now financially independent adults.

More -

BequestYou designate our organization as the beneficiary of your asset by will, trust or beneficiary designation form.

More -

Qualified Charitable Distribution (IRA Charitable Rollover)An IRA Charitable rollover allows people age 70½ and older to reduce their taxable income by making a gift directly from their IRA.

More -

Beneficiary DesignationYou can designate us as a beneficiary of a retirement, investment or bank account or your life insurance policy.

More -

Charitable Gift AnnuityYou transfer your cash or appreciated property to our organization in exchange for our promise to pay you fixed payments (with rates based on your age) for the rest of your life.

More -

IRA to Gift Annuity RolloverYou may be looking for a way to help further our mission and enhance your income. If you are 70½ or older, you can make a one-time IRA rollover to fund a charitable gift annuity and receive fixed payments for life.

More -

Charitable Remainder UnitrustYou transfer your cash or appreciated property to fund a charitable remainder unitrust. The trust sells your property tax free and provides you with income for life or a term of years.

More -

Charitable Remainder Annuity TrustYou transfer your cash or appreciated property to fund a charitable remainder annuity trust. The trust sells your property tax free and provides you with fixed income for life or a term of years.

More -

Charitable Lead TrustYou fund a trust that makes gifts to us for a number of years. Your family receives the trust remainder at substantial tax savings.

More -

Sale and UnitrustYou give a portion of your property to us to fund a charitable remainder trust, when the property sells you receive cash and income for life.

More -

Bargain SaleWe purchase your property for less than fair market value. You receive cash and a charitable deduction for the difference between the market value and purchase price.

More -

Give It Twice TrustYou provide your children with a stream of income while making a gift to charity.

More -

Life Estate ReservedYou give your property to our organization but retain the right to use the property during your life.

More

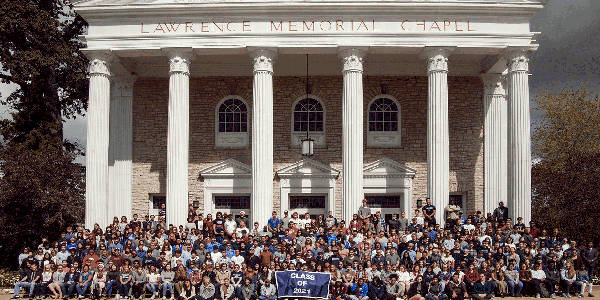

Lawrence-Downer Legacy Circle

The Lawrence-Downer Legacy Circle recognizes alumni, parents and friends who remember Lawrence through a planned gift. We are grateful to the more than 1,090 members of Legacy Circle.